Navigating the challenges and opportunities in the UK legal sector

Maurice MacSweeney speaks to litigators about their prospects for the year ahead as part of a whitepaper investigating growth challenges among leading law firms

The UK legal services sector has much to be proud of. It is, says TheCityUK, “a British success story”, one that continues to make a positive contribution to the UK’s economy despite everything that has happened in recent years.

This has been achieved against the stiff headwinds we all know about – rising and inflationary costs, the expense of hiring and retaining specialised talent, and macroeconomic and political uncertainty. But law firm leaders cannot afford much time to pat themselves on the back. There are still opportunities to grasp, and difficulties to navigate, in a market where competition appears to be getting only fiercer.

Harbour commissioned a survey of 100 law firm leaders from the top 200 firms to ask them what they thought would be their main barriers to growth in 2024, and what tools they planned to use to overcome them. There was much to explore beyond the bare numbers of revenue. The survey results and on-the-record interviews with partners at leading firms have now been published as Harbour’s 2024 White Paper, giving insights into what the top law firms are hoping to achieve in the coming year, and how are they going to finance it.

The lawyers we spoke to were upbeat about the year just gone and the year to come, but then we were speaking mainly to litigators. “Economic uncertainty typically hits transactional colleagues more than us,” says Richard Hornshaw, head of the London disputes team at Akin, “albeit looking ahead, you can see how fewer transactions now could mean fewer disputes in the future.”

Prateek Swaika, a partner at Boies Schiller Flexner, adds: “When people have less money, they want to protect what they have – they need a disputes lawyer to do so. When they have more money, they are more prepared to invest in cases to make bigger returns. It’s a generalised statement but it’s proven right before – I was super busy in the aftermath of the 2008 crash and during Covid I was rushed off my feet assisting our clients with the uncertainties in the market.”

But Malcolm Hitching, a debt finance partner at Macfarlanes, says both contentious and non-contentious business has been “remarkably robust”, despite “all the headlines telling you the world’s in a tricky place”.

Specialist litigation practice Stewarts Law has “relatively lumpy” income and every three to five years sees a big spike off the back of earning a major CFA or DBA fee following a victory in a substantial commercial dispute, says Julian Chamberlayne, risk and funding partner.

That tends to attract headlines in the legal press each year of profits either jumping or slumping, when the reality is strong growth in both income and profit over the medium to long term. Though the last couple of years have been “a little quiet” across the market for mainstream commercial litigation, he says this is starting to pick up, while insolvency cases are also on the rise. Mr Chamberlayne professes himself “reasonably optimistic” for 2024.

For fellow disputes firm Hausfeld, the disruption caused to the economy by global events has actually kept commercial litigation very active, according to partner Ned Beale, who says two of his biggest cases of the last year are for Ukrainian businesses affected by the Russian invasion. Competition work is busy too thanks to the collective action regime in the Competition Appeals Tribunal – which has replaced some of the more traditional cartel follow-on actions that tailed off due to Brexit – while the rise of strategic litigation is another growth area.

Growth challenges

Unsurprisingly, our survey identified continuing economic uncertainty and inflationary pressures as the top challenge to law firm growth in 2024. There were several others too, however, such as a lack of access to capital, partner resistance to change, market consolidation, and talent attraction and retention. A bullish 5% said they did not foresee any barriers to growth.

One very specific issue also facing law firms in the coming year is basis period reform, which will see all partners being taxed on the profits in the actual year they have been accrued, accelerating larger tax bills for many firms.

Evelyn Partners’ annual law firm survey reported that more than half of firms planned to seek additional partner capital to deal with this, only beaten as a solution by making improvements on lock-up management – although historically many firms have found this easier to say than do. Around a third were going to seek external funding.

Cash calls always excite the media – in spring 2023, Withers was in the news for asking junior equity partners to provide a capital contribution for the first time of between £20,000 and £41,000, depending on seniority, “so they are more fully involved in the ownership of the business”. That led to speculation that others would follow suit.

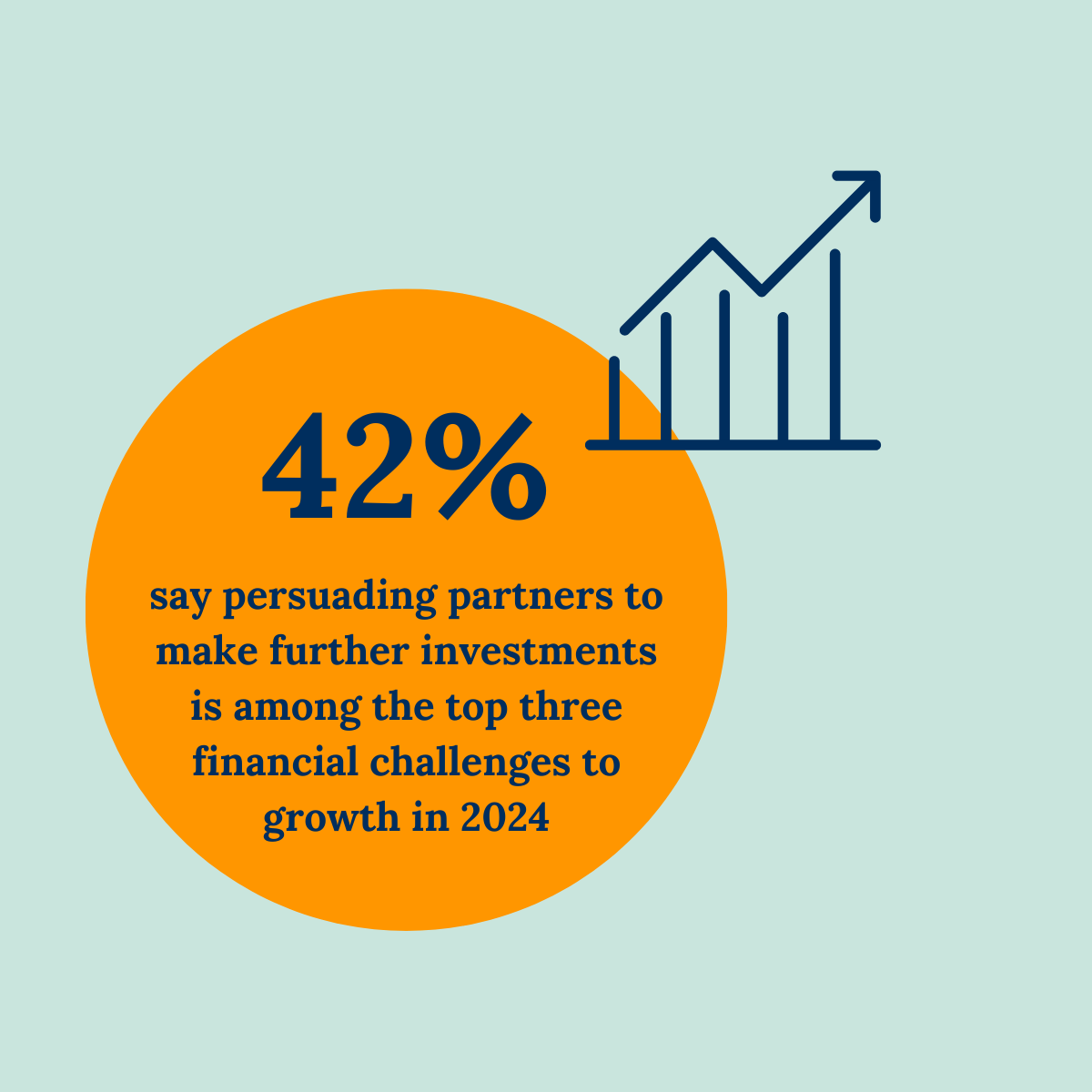

This could raise even further the barrier of partner caution that our survey clearly shows, with persuading partners to make further investments, or seek external investment, named as the biggest financial challenges to growth. Notably, these were followed close behind by lawyers being slower to bill their work – something very much within management’s control.

Of course, partners have always been cautious with their own capital, especially those closer to retirement who do not expect to see the benefits of investment by the time they retire. Taking on a credit facility can make sense in such circumstances, placing the risk on the business rather than the partners, who may as a result be more willing to vote for the investment their firm needs.

Pricing progress

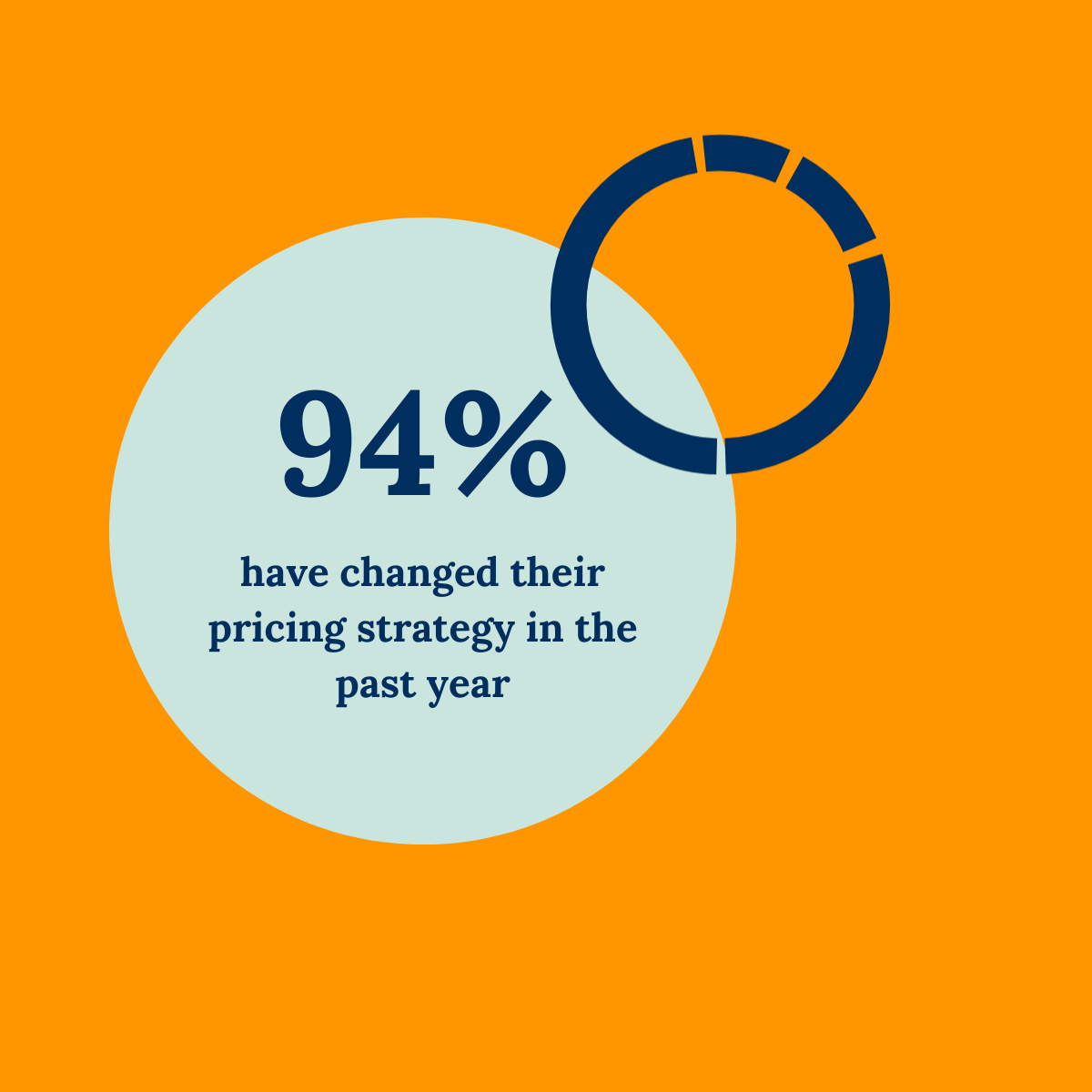

Historically, when everything was done on an hourly rate, law firms had little notion of pricing strategies. And, despite the death knell of the billable hour being tolled on a regular basis in the media, it continues to live on. Nonetheless, particularly in litigation, alternative fee arrangements are undoubtedly in greater demand – our survey shows that a mere 6 per cent of firms have not changed their pricing strategies in the past year. On average, law firms deployed 2.8 of the eight strategies we listed as they experiment with a range of offerings, and 40 per cent also agreed that clients are increasingly shopping around for better rates.

Firms will continue to experiment, with 36 per cent of respondents predicting that many law firms will have to offer more creative billing options to disputes clients.

Ned Beale says most of his own commercial litigation work is billed hourly. Pegging fees to the amount in dispute does not work – all lawyers will tell you that a £100m case is not necessarily more complex than a £10m one – while he is wary of “discarding 200 years of costs history and replacing it with some nebulous concept of value”.

But he, like all of our interviewees, makes clear his willingness to be creative in offering a whole range of funding solutions, albeit these all ultimately boil down to how much risk clients want to take on fees and how much of the success they are willing to share.

Akin’s Richard Hornshaw observes that negotiations over pricing have become “more sophisticated”. At the same time, “it’s not some sort of magic bullet that transforms the landscape for all clients. The flipside of transferring risk through non-recourse funding is transferring upside and not all clients want that”.

More clients are asking about risk-sharing arrangements, says Julian Chamberlayne – some out of necessity but others out of choice. “So, if you want to act for them in big-ticket disputes, you have to come up with innovative fee arrangements,” he says.

Source of funds

It is striking that 36 percent of respondents to our survey said they were offering clients longer payment terms. This obviously risks putting more pressure on their cash flow.

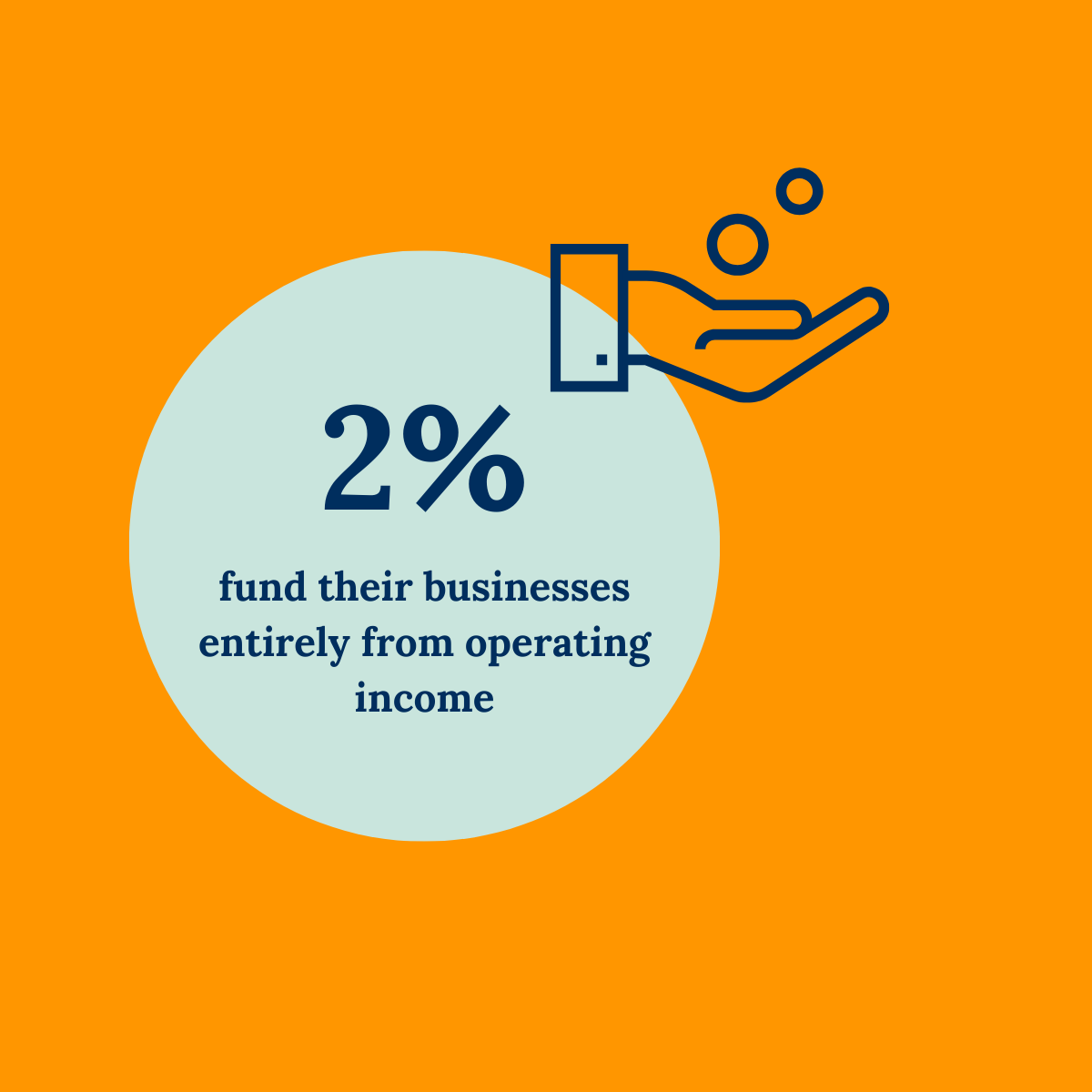

Just 2 percent of the firms we talked to finance themselves entirely from their operating income, with other forms of funding – partner or shareholder investment, private equity, bank overdraft, and litigation funding – all used by significant minorities of firms. On average, firms used 2.4 of the six options offered.

So, might credit facilities from a litigation funder be one way forward? Our survey found almost universal awareness of the option’s existence, with a third saying their firm was actively considering it and most at least open to the idea.

It is the specialist knowledge a funder brings is what appeals to Malcolm Hitching. “Most of these specialist funds are staffed up by former lawyers – they understand law firms, they’ve taken the trouble to really understand how a law firm makes money and they are able to support them accordingly. The average bank does not have that level of expertise.”

Making money work

So where do law firms intend to focus their growth in the coming year – and will it cost them money? Unsurprisingly, most will be looking at existing and new client development (perhaps the question for the 46 per cent of firms that did not list this in their top three priorities is ‘why not?’). Recruitment, M&A and acquiring a complementary non-legal business were the other most highly rated answers, with around 40 per cent naming each.

When it comes to law firm M&A, 42 per cent of our respondents predicted that that 2024 is going to be one of the busiest years for law firm M&A activity. One reason could be recruitment difficulties – acquisition may seem an over-the-top response to that, but for firms looking for very specific expertise, or scale, it is a viable strategy.

It is worth noting too that around one in four respondents also expected to see more law firm insolvencies this year. The fate of Ince & Co and Plexus Law, sold out of administration, sounds a cautionary note to the profession.

Expanding into complementary non-legal businesses is a more positive trend, with Gateley – the first law firm to list in the UK, back in 2015 – using its capital to lead the way. In August 2023, for example, it spent £6m on a chartered surveyors practice in the East Midlands, its 14th acquisition since going public, 11 of which have been non-legal businesses.

Another approach has been taken by legal and professional services group Ampa, which operates a ‘house of brands’ strategy, bringing together businesses but giving them room to grow individually and under their existing brands.

It may not be the easiest of times for law firms but the good ones continue to do well. It was Bill Gates who said we always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten. Law firms need to be ready and need the financial partner who will stand by them as they go on the journey.